Every company faces some version of the “cold start problem”: How to start from scratch? How to attract clients? When your product or service becomes more valuable to users as more people use it, how do you create a network effect that creates incentives for even more customers?

In short, how do you "go to market" and convince potential customers to spend their money, time, and attention on your product or service?

The reaction of most organizations in web2 (internet era defined by large centralized products/services such as Amazon, eBay, Facebook And Twitter, the vast majority of the value of which goes to the platform itself, and not to users) is to invest heavily in sales and marketing teams as part of the traditional strategy market entry (go-to-market - GTM) focusing on lead generation, customer acquisition and retention. But in recent years, a completely new model of organization has emerged. Instead of being controlled by corporations — with centralized leadership making all decisions about a product or service, even when using consumer data and free user-generated content — this new model uses decentralized technologies and puts users into the role of owners through digital primitive known as tokens.

This new model, known as web3, changes the whole idea GTM for these new types of companies. While some traditional customer acquisition schemes are still relevant, the introduction of tokens and new organizational structures such as decentralized autonomous organizations (DAO), requires a variety of approaches to market entry. Because the web3 still new to many, but there is a huge development going on in this space, in this article I am sharing some new circuits to think about GTM in this context, as well as where different types of organizations may exist in an ecosystem. I will also offer some tips and tactics for developers who want to create their own strategies. web3 GTMas this space continues to evolve.

Catalyst for New Movements in the Market: Tokens

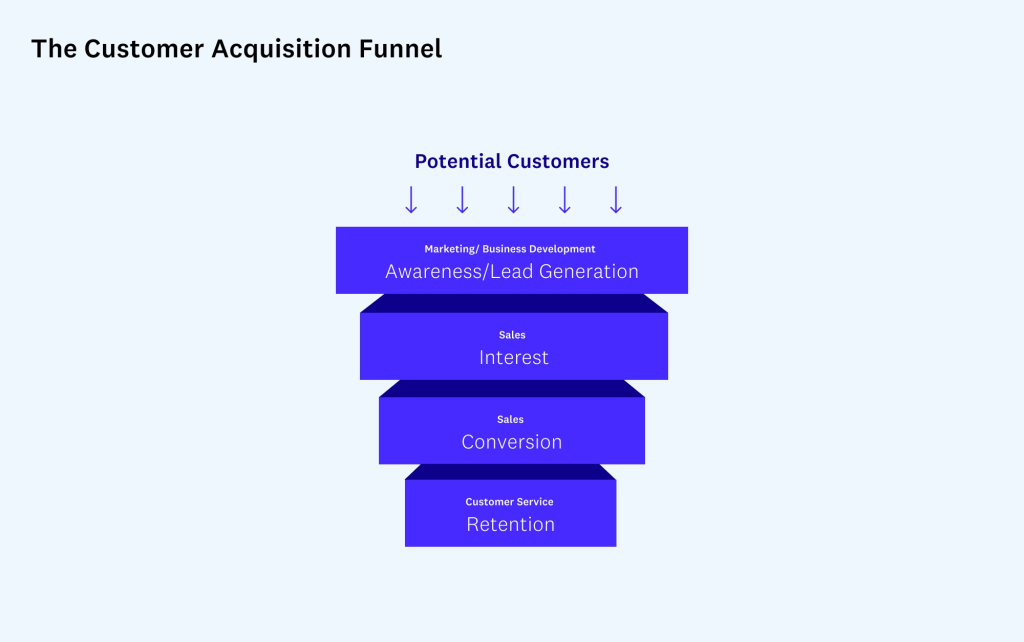

The concept of the customer acquisition funnel is fundamental to go to market and is familiar to most companies: from attracting attention and generating leads at the top of the funnel to converting and retaining customers at the bottom of the funnel. Therefore, the traditional web2 go-to-market solves the problem of cold start through this linear prism of customer acquisition, covering areas such as pricing, marketing, partnerships, sales channel planning, and sales force optimization. Success metrics include, in particular, time to lead closure, site conversion rate, revenue per customer.

Web3 changes the whole approach to creating new networks, as tokens offer an alternative to the traditional approach to the cold start problem. Instead of spending money on traditional marketing to generate and acquire leads, core development teams can use tokens For attracting early adopterswho can then be rewarded for their early contributions when network effects were not yet apparent or had not begun. Not only are these early adopters the conduits that bring more people to the network (who would like to be rewarded for their contributions), but it makes the early adopters web3 more influential than traditional business development or sales professionals in web2.

For example, credit protocol Compound used tokens to incentivize early lenders and borrowers by providing additional rewards in the form of tokens COMP for participation or “self-generation of liquidity”** in the liquidity extraction program. Any user of the protocol, be it a borrower or a lender, received tokens COMP. After the launch of the program in 2020 TVL (Total Value Locked) is the total value of the locked cryptocurrency) in Compound jumped from ~$100M to ~$600M. It is worth noting that although token incentives attract users, this alone is not enough to make them sticky; more on that later. While traditional companies incentivize employees through equity, they rarely financially incentivize customers in the long run (other than through acquisition discounts or referral bonuses).

Let's summarize: IN web2 main stakeholder GTM is a customer who is usually acquired as a result of sales and marketing efforts. In web3, an organization's GTM stakeholders include not only customers/users, but also developers, investors, and partners. Therefore, many web3 companies consider the roles of the community to be more important than the roles of the sales and marketing department.

Web3 Go-to-Market Matrix

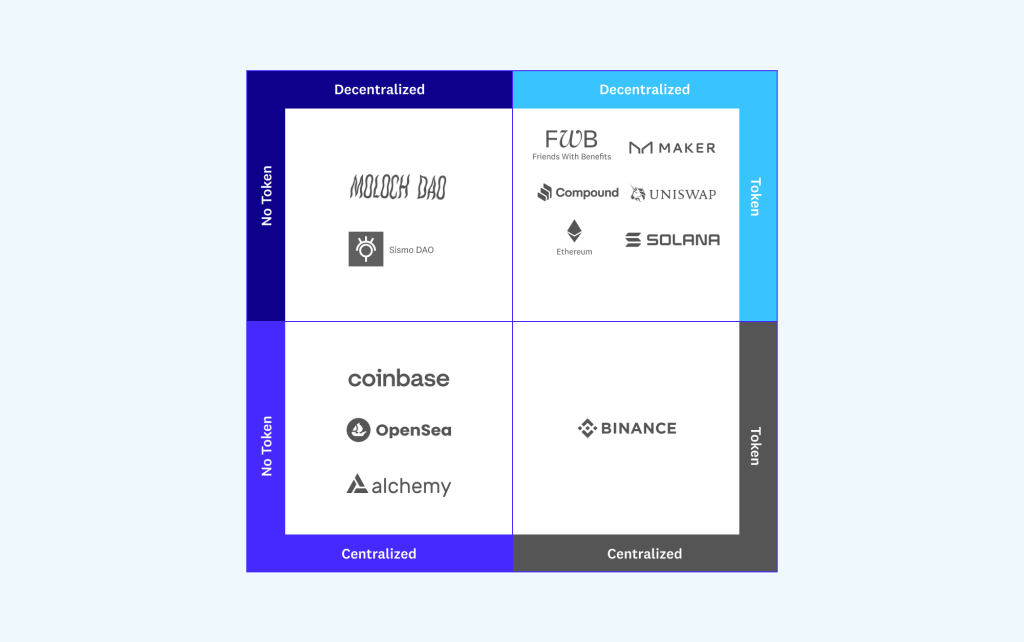

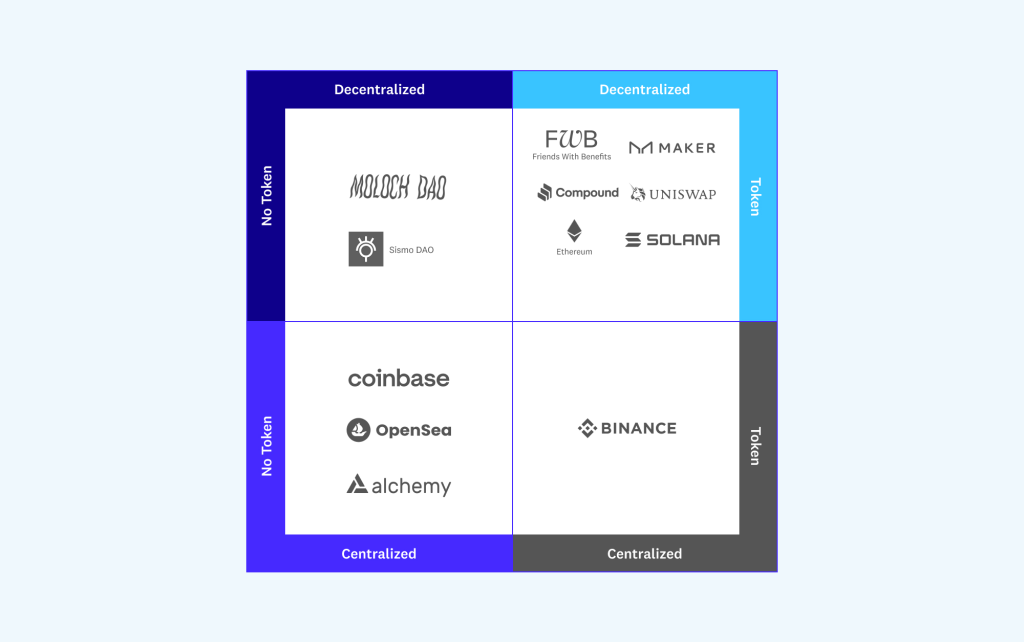

For web3 organizations GTM strategy depend on where an organization ranks in the matrix below, according to its organizational structure (centralized vs. decentralized) and economic incentives (with tokens vs. without tokens):

Go-to-market is different in each of the quadrants and can span everything from traditional web2-style strategies to new and experimental strategies. Here I will focus on the upper right quadrant (decentralized team with a token) and compare it with the lower left quadrant (centralized team without a token) to illustrate the difference between the approaches. web3 And web2 GTM.

Decentralized team with a token

Let's look at the upper right quadrant first. This includes organizations, networks, and protocols with unique web3 operating models, which in turn require new go-to-market strategies.

Organizations in this sector follow a decentralized model (although they usually start with a core development or operations team) and use economics of tokens to attract new members, reward contributors, and negotiate incentives among members. (For an in-depth discussion of web3 business models and the seeming paradox of value capture, check out with this report from the school of crypto startups a16z).

The fundamental difference between web3 organizations in this sector and organizations using the more traditional GTM model lies in a key question: What is a product? If web2 companies and companies in the bottom left quadrant are mostly should start from a product that will attract customers (“come for the tools, stay for the network”), then web3 companies approach market entry through two lenses − target And community.

Having a product and a solid technical base is still important, but it shouldn't come first.

What do these organizations really necessary is a clear purpose that defines the reason for their existence. What is the problem they are trying to solve? It also means more than just raising money based on a white paper* and a founding team. It means having a strong community – not only being “community-led” or “community-first”, but also belong to the community — the line between owner, shareholder and user is blurred. What makes web3 successful in the long term is a clear purpose, an engaged and high-quality community, and the right organizational management to match that purpose and the community.

Now let's delve into the go-to-market movements in the two main categories of web3 organizations in the upper right quadrant: (1) decentralized applications; and (2) layer 1 blockchain, layer 2 scaling solutions, and other protocols.

GTM mechanisms for decentralized applications

“Decentralized Applications” includes use cases such as decentralized finance (DeFi), non-functioning tokens (NFTs), social networks, and games.

Decentralized Finance (DeFi) DAO

One of the main categories of decentralized applications are decentralized financial (DeFi) such as decentralized exchanges (like Uniswap or dYdX) or stablecoins (like Dai from MakerDAO). While they may have similar go-to-market motivations with standard dapps, value is accumulated differently due to organizational structures and token economics.

Many DeFi projects go the route where the protocol is first developed by a centralized development team. After the launch of a protocol, the team often seeks to decentralize the protocol in order to increase its security and transfer control of its operation to a decentralized group of token holders. Such decentralization is typically accomplished by simultaneously issuing a governance token, running a decentralized governance protocol (usually a decentralized autonomous organization, or DAO), and transferring control of the protocol to the DAO.

This process of decentralization may involve many different structures and forms of organization. For example, many DAOs do not have any legal entities associated with them and operate exclusively in the digital world, while others use multi-sig (“multisig”) wallets that operate at the direction of the DAO. In some cases, non-profit foundations are set up to oversee the future development of the protocol at the behest of the DAO. In almost all cases, the original development team continues to act as one of the many contributors to the ecosystem created by the protocol and to develop complementary or ancillary products and services. (In that technical paper for more information on the legal framework for a DAO, from taxation and incorporation to operational issues and considerations).

Here are two popular DeFi examples:

- MakerDAO started as a DAO in March 2015, established a foundation in June 2018, and ceased operations in July 2021. MakerDAO has a stablecoin, Dai, which aims to enable users to make fast, low-cost, borderless, and transparent transactions with a stable unit of value. This could be the purchase of goods and services, or interactions with other DeFi applications. The DAO also has a governance token, MKR. The DAO approves various governance changes as well as some of the parameters of the protocol, including the collateral ratios that the protocol uses to mine DAI.

- Protocol Uniswap was launched by a centralized company, but is now owned and operated by Uniswap DAO, which is controlled by UNI token holders. Uniswap Labs, the creator of the protocol, manages one interface to the Uniswap protocol and is one of many developers contributing to the protocol ecosystem.

What does the market entry look like here? Take the example of Dai, an algorithmic stablecoin issued and managed by MakerDAO. One of the goals of most algorithmic stablecoin issuers such as MakerDAO, is to enable wider use of their stablecoins in the financial ecosystem. Therefore, promotion to the market is to: 1) be placed on cryptocurrency exchanges for retail and institutional trading; 2) integrate in wallets and applications; and 3) be accepted as payment for goods or services. Today there are more 400 Dai markets, He integrated into hundreds of projects, and is accepted as a form of payment through major merchant solutions such as Coinbase commerce.

How did they do it? Initially MakerDAO achieved this through a more traditional business development team that was the driving force behind many of the early partnerships and integrations. However, as decentralization has grown, the business development function has become the responsibility of main growth unit, a sub-community of Maker token holders, often referred to as SubDAO. Also, since MakerDAO is decentralized and its protocol is trustless and permissionless, anyone can generate or buy Dai using this protocol. And because Dai's code is open source, developers can integrate it into their apps in a self-service fashion. Over time, the protocol has become more self-supporting—with better developer documentation and more integration guides—other projects have been able to evolve it at scale.

Market Entry Metrics for DeFi DAO

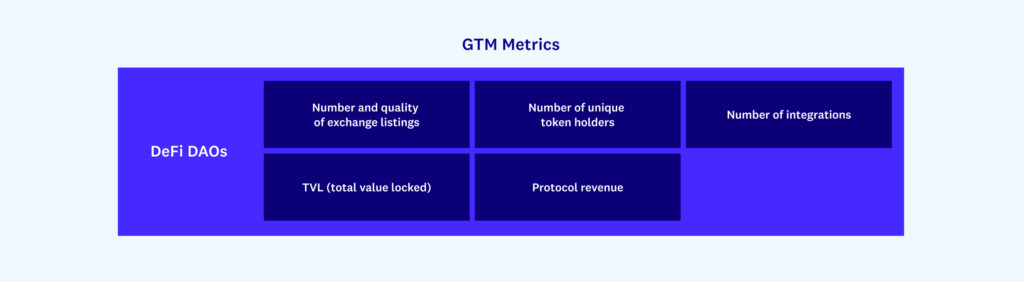

With new go-to-market strategies for web3 come new ways to measure success. For DeFi applications, the canonical success metric is the aforementioned Total Cost Locked (TVL). It represents all assets that use a protocol or network for purposes such as trading, betting, and lending.

However, TVL is not an ideal metric to measure the long-term health and success of an organization. While new DeFi protocols can replicate open source, offer high yields, and attract significant financial inflows and TVL, this is not always sustainable - traders often leave as soon as the next project appears.

Therefore, areas such as the number of unique token holders, community activity and mood, and developer activity are more important metrics to track. Also, since the protocols are composable - they can be programmed to interact and create each other - another key metric here is integration. The number and type of integrations track how and where the protocol is used in other applications such as wallets, exchanges, and products.

DAO in the social sphere, culture and art

For DAOs in the social, cultural, and arts, going to market means building a community with a specific purpose—sometimes even starting as a text chat between friends—and growing it organically by finding other people who believe in that same purpose. But isn't this "just a group chat" or the same traditional crowdfunding as, for example, on Kickstarter?

No, because while the organizers of traditional web2 crowdfunding projects may also have a clear goal, they have to much more clearly define the means to achieve this goal from top to bottom. Project proponents typically detail how the funds raised will be used, a clear product roadmap, and a comprehensive timeline. In the web3 model, the goal is paramount, but the methods are often defined later—including the product roadmap, timelines, and how the funds will be used.

For example, for ConstitutionDAO, the purpose was to purchase a copy of the US Constitution; For Krause House, - purchase of the NBA team and innovative management of the team by the fans; For LinksDAO, — creation of a virtual country club with a community of golf lovers; and for PleasrDAO, collection, display and creative addition/sharing with the NFT community to present culturally significant ideas and movements.

In the case of ConstitutionDAO, which brought in $47M from a community of strangers united around this goal, the whole process was organized over the course of several weeks and started with a clear goal and fundraising for that specific goal only. ConstitutionDAO had nothing else - no clear roadmap, no implementation plan, not even a token at that time (it was created after an unsuccessful proposal). The people who contributed financially were so close to the goal and motivated by the community that they just wanted to contribute and spread the word, filling out Twitter emoji scrolls that have become a meme.

Friends with Benefits is a tokenized social DAO that started out as a tokenized Discord server for web3 creatives. In addition to the minimum contribution of $FWB tokens, which represents DAO membership, prospective members must apply to the FWB through a written application. The community grew, chatted on various Discord channels, hosted IRL events, and eventually realized that one of the products they could create was event app using tokens. The FWB gives creatives a real stake in the community, and the DAO structure allows for large-scale coordination of this decentralized social group to perform tasks such as budget allocation and project execution, from publishing content to organizing events.

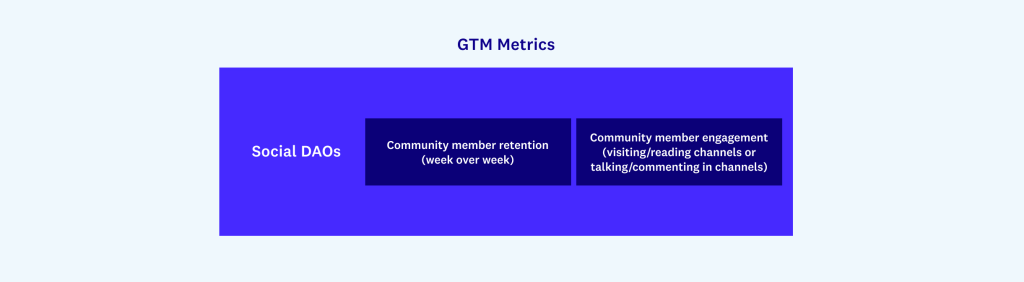

Go-to-Market Metrics for Social DAOs

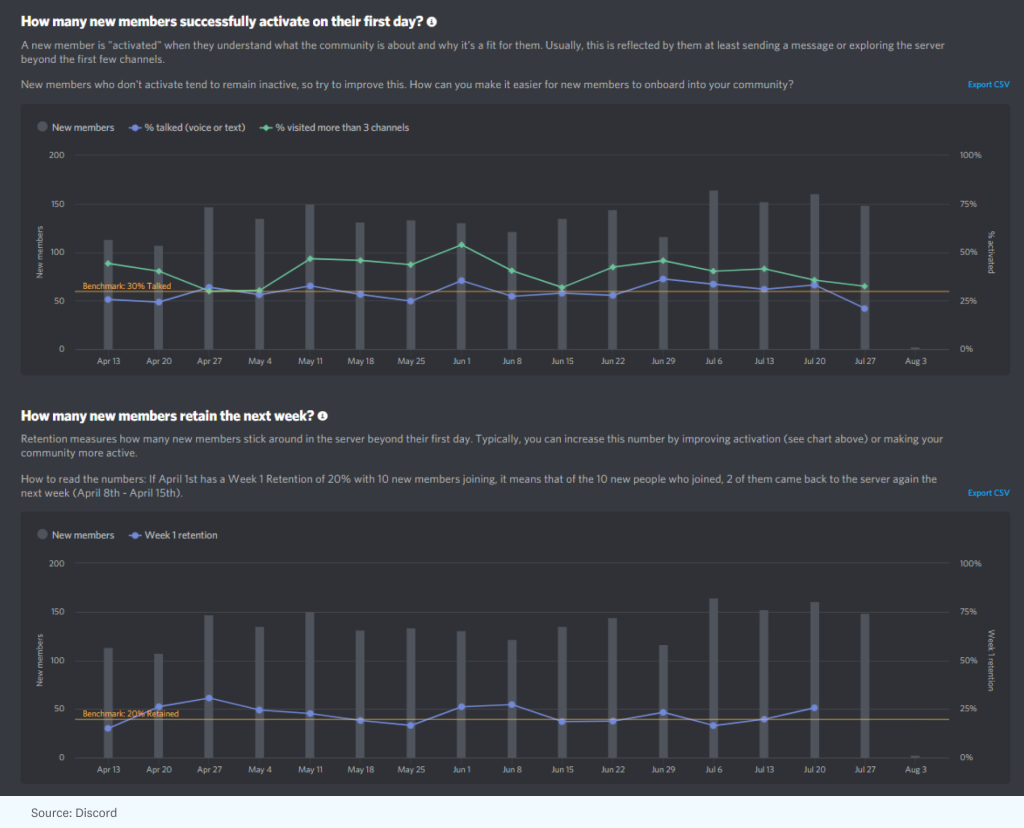

One of the key indicators of a DAO's health is the quality of community engagement, which can be measured through the main communication and management platforms it uses. For example, a DAO can track Discord channel activity, community member activation and retention, participation in community meetings, governance participation (who votes and how often), and actual performance (number of paid contributors).

Other metrics can be new network relationships built or measurement of trust between members of the DAO community. Although some tools and mechanisms already exist, social metrics DAO is still an evolving space, so we will see how new tools will emerge and evolve as this space evolves.

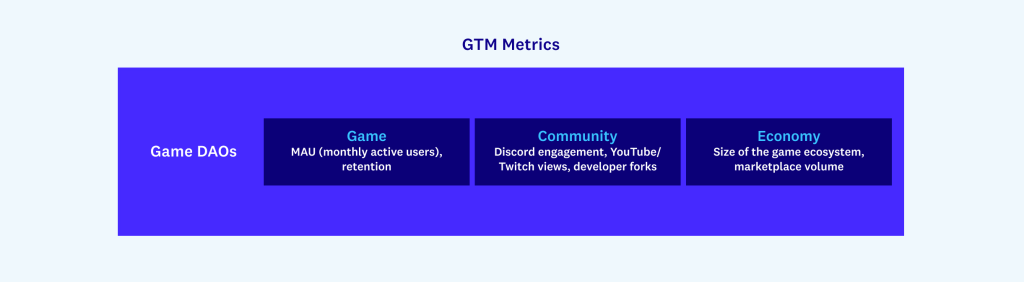

Gaming DAOs

Today, most web3 games, whether play-to-earn, play-to-mint, move-to-earn or others, are very similar to the popular web2 counterparts - but with two key differences:

- Using in-game assets on open, global blockchain platforms rather than closed, controlled economies as in traditional pay-to-play and free-to-play games; And

- An opportunity for players to become true stakeholders and have a say in the governance of the game itself.

In web3 games, the go-to-market strategy is built through platform distribution, player acquisition, and partnerships. with guilds. Guilds such as Yield Guild Games (YGG) allow new players to start playing the game by providing them with in-game assets that they might not be able to afford. Guilds select games to support based on three factors: game quality, community strength, and the reliability and fairness of the game economy. The health of the game, the community and the economy must be maintained in tandem.

While blockchain game developers may have a lower percentage of ownership and/or profit share, by incentivizing players as owners, developers contribute to the growth of the overall economy for all.

But unlike web2, the goal and the community play a leading role here. For example, Loot, a game that started with content first and then moved on to gameplay, is an example of how purpose and community, not product, define GTM. Loot is a collection of NFTs, each of which is known as a Loot bag and contains a unique combination of adventure gear items (examples: dragonskin belt, fury silk gloves, and enlightenment amulet). Loot is essentially a hint - or primitive building block - upon which games, projects, and other worlds can be built. Loot Community created everything from analytics tools to derivative art, music collections, realms, quests and other games inspired by their Loot bags.

The key idea here is that Loot grew not because of an existing product that users flocked to, but because of the idea and story it represented—an open, composite network that welcomed creativity and incentivized users through tokens. The community creates the product itself, not the network creates the product in the hope that it will attract the community. Therefore, the key indicator here can be, for example, the number of derivatives, which can be considered even more valuable than traditional indicators.

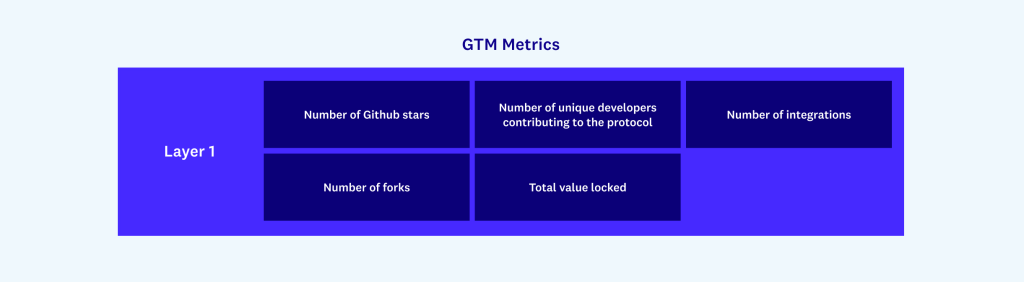

GTM Movements for Layer 1 Blockchain and Other Protocols

In web3, layer 1 refers to the underlying blockchain. Avalanche, Celo, Ethereum, and Solana are all examples of Layer 1 blockchains. All these blockchains are open source, so anyone can build on them, copy or modify them, and integrate with them. The growth of these blockchains is due to the fact that more and more applications are being created on their basis.

Tier 2 refers to any technology that works on top of the existing Tier 1 to help solve the scalability issues of Tier 1 networks. One type of Tier 2 solution is wrapping. Level 2 collapse does exactly that - it "rolls" off-chain transactions and then passes the data back to the layer 1 network through the bridge. There are two main categories of second level rollups. The first, optimistic rollups, "optimistically" assumes that the transaction is fair and not fraudulent with the help of proof of fraud. The second, zk-rollups, uses proofs “zero knowledge” to define the same. Most of these second layer solutions are currently being developed for Ethereum and do not yet have a native token, but we will discuss them here as their go-to-market success rates are similar to those of other networks in this category.

In addition, protocols can be built on top of other Tier1 or Tier2, for example Uniswap protocol supports Ethereum (Tier1), Optimism (Tier2) and Polygon (Tier2).

The growth of layer 1 blockchains, layer 2 scaling solutions, and other protocols can come from forks, where the network is copied and then modified. For example, Ethereum, the first layer blockchain, was a fork of Celo. Optimism, a layer two scaling solution, was a fork of Nahmii and Metis. And Uniswap was a fork to create SushiSwap. While it may seem negative at first, the number of forks a network has can actually be a measure of success - it shows that others are willing to copy it.

All these examples and mindsets are focused on the upper right, decentralized networks with tokens - in general, these are the most modern examples of web3. However, depending on the type of organization, there are still a fair number of combinations of web2 GTM strategies and emerging web3 models. Developers need to understand a range of approaches when they start developing their go-to-market strategy, so let's now look at a hybrid model that combines web2 GTM and web3 GTM strategies.

Centralized and Tokenless: A web2-web3 hybrid

Many companies in the lower left quadrant (centralized command without tokens) provide users with entry points and interfaces to access the web3 infrastructure and protocols.

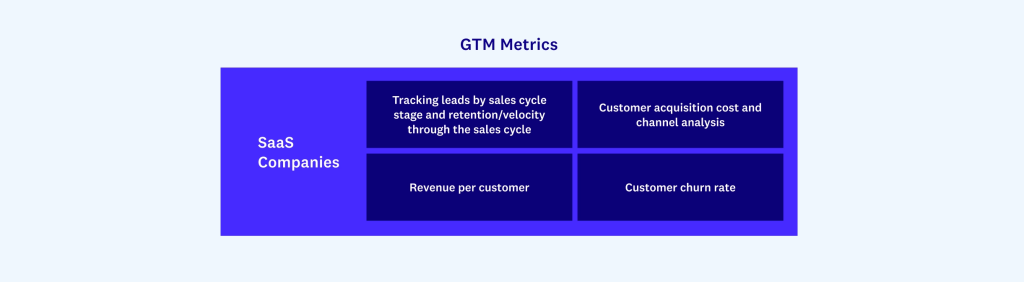

There is a significant overlap in go-to-market strategies between web2 and web3 in this sector—especially in the area of SaaS and marketplaces.

software-as-a-service

Some companies in this quadrant are pursuing a traditional software-as-a-service (SaaS) business model, such as Alchemy, which exposes nodes as a service. These companies offer on-demand infrastructure through various subscription fees based on factors such as storage requirements, dedicated or shared hosts, and monthly request volume.

The SaaS business model typically requires traditional movements and incentives to go to market in the web2 format. Customer acquisition is done through a combination of product and channel based strategies:

Product attraction aimed at getting users to try the product itself. For example, one of Alchemy's products is Supernode, an Ethereum API aimed at any organization that builds on Ethereum but doesn't want to manage their own infrastructure. In this case, customers try Supernode through the free tier or freemium model, and those customers recommend the product to other potential customers.

In contrast to this, channel engagement focused on segmenting different types of customers (such as public sector and private sector customers) and building sales teams around these customers. In this case, the company may have a sales force focused exclusively on public sector clients, such as government and education, and with a deep understanding of the needs of this type of client.

In this article, I'm providing an overview to help explain the difference between web2 and web3 go-to-market strategies, but it's important to note that working with developers and interaction with them —Including developer documentation, events, and training.

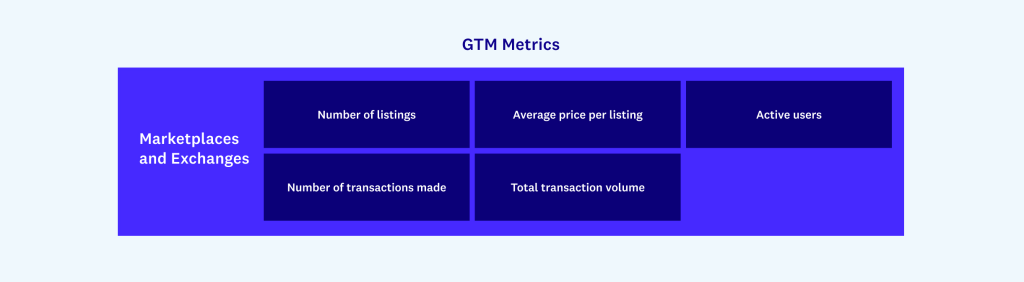

Marketplaces and exchanges

Other companies in the sector rely on marketplace and exchange models that are relatively familiar to consumers, such as the peer-to-peer horizontal NFT marketplace. opensea and cryptocurrency exchange Coinbase. These companies are making money.”take” - based on a transaction fee (usually a percentage of the transaction), which is similar to the business models of classic web2 marketplaces such as eBay and Amazon.

For these types of companies, revenue growth comes from increased ad counts, average dollar value per ad, and platform users, all of which lead to increased transaction volume, benefiting users in terms of diversity, market liquidity, and more.

The key move in the market here is to expand the distribution channel by partnering with other platforms to showcase the range of products. It's like an Amazon affiliate program where bloggers can link to their favorite products and any purchases made through those links earn the blogger a commission. But the key difference from web2 is that web3 structures allow royalties to be paid. back to the creator in addition to affiliate commission. For example, OpenSea offers a traditional affiliate sales channel through its White Label program, in which purchases made through a referral link earn a percentage of the sale to an affiliate, but it also allows royalties, in which creators can continue to earn a percentage of any secondary sales. (This web3 feature is unique thanks to cryptocurrencies since smart contracts can encode the percentage agreement in advance, the blockchain keeps track of the origin, etc.).

Because creators now have the ability to continue to monetize their work through secondary markets, they have an incentive to continue to market: value they could not previously see, let alone capture, in web2 systems. Creators also become promoters.

GTM tactics

Now that I've covered the key setups and use cases, let's take a look at specific go-to-market tactics that are common in web3 organizations. These are the basics and not a complete guide to action, but they can still help developers new and exploring this space to understand the tactics and possibilities.

Airdrops

An airdrop is when a project distributes tokens to users to reward certain behaviors the project wants to incentivize, including network or protocol testing. They can be distributed to all existing addresses in a given blockchain network or targeted (for example, to specific key influencers); often they are used to solve the problem of "cold start" - to stimulate early adoption, reward or encourage early adopters, etc.

In 2020 Uniswap airdropped 400 UNI to everyone who used the platform. In September 2021, dYdX sent to DYDX usersMost recently, ENS conducted airdrop to everyone who has an ENS domain (decentralized domain .eth); the mailing was done in November 2021, but everyone who owned an ENS domain before October 31, 2021 was/are eligible (until May 2022) to claim $ENS tokens, which grant owners the right to control the ENS protocol.

In the non-fungible token space, airdrops for NFT projects are also growing in popularity to help provide access to more people for other reasons. One of the recent notable airdrops was Bored Ape Yacht Club, a collection of 10,000 unique NFTs; On August 28, 2021, BAYC created the corresponding Mutant Ape Yacht Club. Each holder of BAYC tokens received serum mutationto create 10,000 "mutant" monkeys, and an additional 10,000 new mutant monkeys were made available to new members. Because there were different types of sera, sera could only be used once, and since Bored Ape couldn't use multiple sera at the same level, sera added a new deficiency model.

Meaning creation of MAYC was to "reward our monkey owners with a brand new NFT" - a "mutant" version of their monkey - while allowing newcomers to enter the BAYC ecosystem at a lower membership level. This maintains accessibility to the wider community, while not diluting the original set's exclusivity or making the owners of the original set feel like their contributions have been downplayed. (Another way to solve the accessibility problem is NFT fractionationwhen the NFT has multiple owners). MAYC's floor price, or the lowest listed price for MAYC, is consistently lower than BAYC's floor price, but holders essentially have the same benefits.

These airdrops were done retroactively to reward NFT holders or users of the network and protocols (similar to the ENS airdrop), but airdrops can also be used as a proactive GTM movement to raise awareness of a particular project and encourage people to check it out. Since the information on the blockchain is public, a new project can airdrop, for example, to all wallets using a particular marketplace, or to all wallets holding a particular token.

In any case, projects should clearly articulate their overall token distribution, breakdown, and plans prior to airdropping. There are many examples of the misuse of airdrops and failed airdrops. In addition, in the US, token airdrops can be treated as a placement of securities, so projects should consult with a lawyer before embarking on such activities.

Developer grants

Developer grants are grants awarded from the protocol treasury to individuals or teams that contribute in some way to improving the protocol. This can serve as an effective GTM mechanism for DAOs, as developer activity is integral to the success of the protocol. Examples of projects and protocols with developer grants are Celo, Chainlink, Compound, Ethereum, And Uniswap.

But grants can be given for everything from protocol development to bug fixes, code audits, and other non-coding activities. Compound even has grant type related to business development and integrations, funding any integrations that expand the use of Compound. An example is a grant for the integration of Compound with Polkadot.

memes

Viral images with text overlays are another GTM tactic for web3 organizations. Given the complexity and breadth of the cryptocurrency ecosystem, as well as the short attention span of social media users, memes allow for the rapid transfer of information. Memes can also signal belonging, community, goodwill and much more in a very informative way.

The NFT project Pudgy Penguins, a collection of 8,888 penguins, got off to a flying start thanks to its memorability. The initial batch of the collection was sold out in 20 minutes, and about the collection featured large media, which, in turn, contributes to the popularization of such projects. Social display and the "PFP" (profile image) community element - in web3 this happens in the form of PFTs displayed as the owner's social media profile image - also allow for this virality. Twitter recently launched a feature that allows users to verify ownership of NFTs using hexagon-shaped profile pictures with a link to the OpenSea API.

Owners with a large social media following increase awareness of a project when they change their profile picture to that project's image, and project owners typically follow all other owners of the same project. Such moves, in turn, can give rise to other memes, as in the case of CryptoCovens and the “web2 me vs. web3 me" when users began to show their witches along with their real faces, signaling identity, belonging and more.

***

What does all this mean for the founders of web3? The biggest shift in thinking is moving away from planning to something more like gardening.

In web2 companies, the founders not only define the top-down vision, but they are also responsible for growing the team, planning, and executing that vision. At web3, the founders play more of a role as a gardener, helping to grow and develop potentially successful products while also creating the space for it all to happen. While the founders of web3 still define the purpose of the organization and its original governance structure, the governance structure itself can quickly lead to new roles for them. Instead of optimizing headcount growth, revenue, and profitability, founders can optimize protocol usage and community quality. In addition, after any decentralization, the founders must adapt to an environment where there are no hierarchical power structures and where they are one of the many actors who advocate for the success of a particular project. Therefore, before decentralization, the founders should make sure that they set up their project to succeed in such an environment.

I saw some of this first hand when I was chief of staff to Tony Hsieh, the former CEO of Zappos.com, an e-commerce company now owned by Amazon. Since 2014 the company experimented with more decentralized (compared to top-down) governance structures, including a self-organized governance system known as "holacracy". Holacracy involved a hierarchy of work, not people, and had mixed results. But Hsieh offered a useful metaphor, comparing his role to that of a cultivator of a greenhouse with plants (in the holacracy model), rather than the best plant. He said he needs to begreenhouse architect” - to create the right conditions for all other plants to flourish and prosper.

Today Alex Zhang, head of Friends with Benefits (FWB), a social DAO with fungible tokens, echoes him, describing that his job "is not to set a top-down vision", but to facilitate the creation of "frameworks, permissions and rules for members of the community" that they can approve and develop from them. Where the web2 leader is focused on updating the product roadmap and driving new product launches, Zhang sees himself as more of a gardener than a top-down builder. His role is to oversee and curate the FWB "neighbourhood" (in this case, the Discord channels) by removing low-traction channels and helping support and grow channels that are gaining traction. By creating a framework for these channels—and "game books" for channel success (such as a mix of activity, clear leadership, and governance structures)—Zhang becomes more of an educator and communicator.

In the case of the founders of NFT projects, their role is primarily that they are the creators and temporal stewards of intellectual property (IP). Yuga Labs, creators of Bored Ape Yacht Club, wrote, “We see ourselves as temporary administrators of the IS, which is in the process of increasing decentralization. We're committed to being a community-owned brand with tentacles in world-class gaming, events and streetwear." Ownership of an NFT—whether in an image, video or sound clip, or other form—transfers to the owner all rights associated with the NFT. When NFTs are bought and sold, this ownership is transferred—and as the ecosystem around the NFTs develops, the owner of the NFTs, not just the founding team of the NFT project, gains these benefits.

NFT ownership can also be associated with community-driven licensing and community-driven content (as opposed to traditional IP franchises). An example is Jenkins The Valet, an NFT avatar from the BAYC collection (specifically Ape #1798), who has signed a contract with Creative Artists Agency (CAA) to appear in various forms of media. Jenkins was created by Tally Labs, the group that owns Ape #1798. Tally Labs decided to give the monkey its own brand and backstory and turned the idea that statistical rarity NFT is the main determinant of its price and success. They then created an opportunity for others to participate in creating content around Jenkins through “"writer's room" NFTwhere, for example, community members could vote for genre first book.

Much is possible in this area; we have yet to see what else is possible as more people embrace cryptocurrencies, decentralized technologies and web3 models. The traditional web2 GTM framework is a useful reference and offers some useful game play—but these are just a few of the many frameworks available to web3 organizations. The main difference to keep in mind is that the goals, growth, and success rates of web2 and web3 are often not the same. Creators must start with a clear goal, grow the community around that goal, and tailor growth strategies and incentives for the community accordingly, and with them the motives for entering the market. We will witness the emergence of various models, and look forward to watching them and sharing information here.

Thanks to Justin Payne, Porter Smith, and Miles Jennings for their contributions to this article.

🔥Do you want to create your own web project but don't know where to start? Community HareCrypta ready to offer you exclusive services consulting for development and access to web3! Find out more on our website!

Translation author articles: Inna