Tapioca DAO - This first ever omnichain protocol on LayerZero.

Omnichain technology greatly enhances capital efficiency, making it more accessible and offering new opportunities for lending and borrowing. This allows users to get the best results in the form real yield. With its modular LayerZero infrastructure, Tapioca is able to offer its users unparalleled capital efficiencies and improve the user experience in DeFi without the need to intermediary intervention.

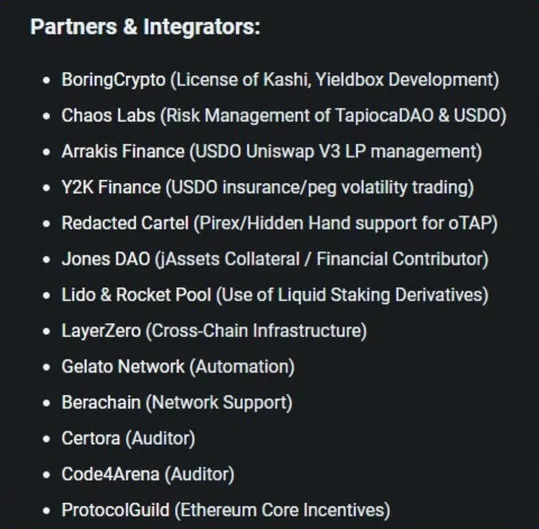

Tapioca has a long list notable partnerships. And all this with zero cost for marketing.

TAP Token is the core element of the Tapioca DAO economy. Its creation is carried out using a unique and innovative approach to the design of tokenomics, which is aimed at sustainable development in the long term, ensuring economic growth and value retention. The main goal is widespread TAP token to reach maximum decentralization in the Tapioca DAO ecosystem.

It is proposed to distribute 100 million Tapioca DAO (TAP) tokens over 6 years using an exponential decay curve and a DSO buyout process. Once all tokens have been distributed, no more new TAP tokens will be created, as their number will be fixed.

oTAP token is an incentive token that can be transferred; this is the main mechanism used to stimulate the economic growth of the Tapioca protocol.

A simplified example of how this works: users deposit liquidity into the lending market and receive a receiving token called "tOLP". They can lock this token for a set period of their choice. Based on the Tapioca AML (Average Magnitude Lock) formula, a discount factor is applied to the receiving token, which is valid for the entire lock period. At the end of each period (approximately one week), users receive an oTAP with a specified strike price. Users have the right, but not the obligation, to buy TAP at this exercise price. The discount is fixed and based on an average lock formula ranging from 5 to 50%.

The system benefits both users and protocols. Users can buy TAP at a reduced price and sell it for a profit, or lock TAP in twTAP (which has other benefits).

twTAP token is created when the user blocks TAP for the selected duration. twTAP can also be transmitted. twTAP is also used for governance and may influence oTAP rewards distributed through voting.

USDO is the first decentralized, multi-collateralized, non-algorithmic and censorship-resistant stablecoin pegged to the US dollar. USDO uses the super-standard LayerZero OFT20 V2 token, which allows it to be instantly transported (minted and burned) across chains (EVM and non-EVM compliant networks) without any bridge or other intermediary, which eliminates slippage, latency, and fees.

USDO will only be backed by decentralized and highly liquid network gas tokens such as ETH, MATIC, AVAX, FTM and their LSDs (derivative liquid staking) such as Lido's stETH and stMATIC. This is what gives USDO censorship resistance. The main USDO peg protection mechanism works through incentives for arbitrage transactions in the Tapioca ecosystem, as USDO is hard-pegged to $1 under the Tapioca protocol.

Distribution of tokens

Tapioca there will be no presale. Will Liquidity Bootstrapping Pool (LBP)which will take place in May/June. Distribution:

- LBP > Buyers in LBP receive 1/3 oTAP airdrop at a discount of 50% from the final price of LBP;

- Guild members - oTAP airdrop (30-50% discount);

- Pearl club NFT owners;

- Rest.

Pearl club NFT

Pearl Club by Tapioca DAO is a collection of 713 hand-drawn animated Omnichain NFTs (LayerZero ONFT-721) that will exist on Arbitrum, Ethereum, Optimism, Polygon, Avalanche and BNB Chain.

Tapioca Activities: Minting, Borrow, Lending

Minting. The Tapioca mechanism allows USDO to be created with many different collateral assets from several different EVM and non-EVM blockchains. Basically, you open a CDP (Collateralized Debt Position) with an accepted token as collateral and in return receive an amount in USDO according to LTV (Loan to Value Ratio). For example, 90% LTV means you can receive up to 900$ in USDO for every 1000$ in collateral you provide. Read more…

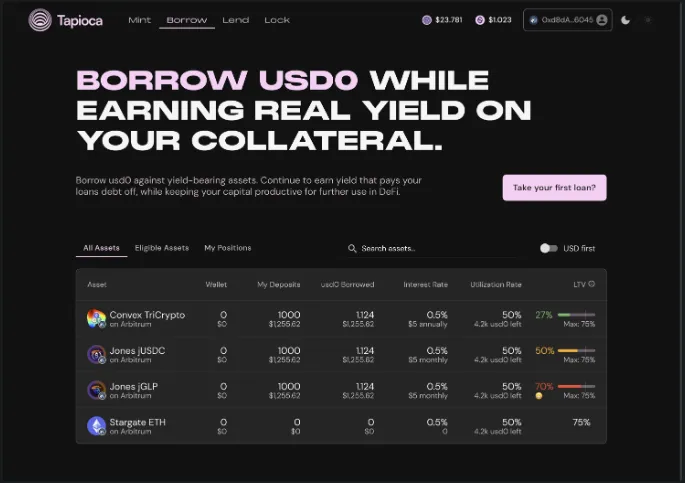

Borrow. To borrow USDO, you need to deposit collateral tokens to create a CDP (Collateralized Debt Position). Different markets accept different collateral assets that have a certain loan-to-value ratio (LTV). The LTV of the markets determines the amount you can borrow based on the amount you deposit as collateral. Read more…

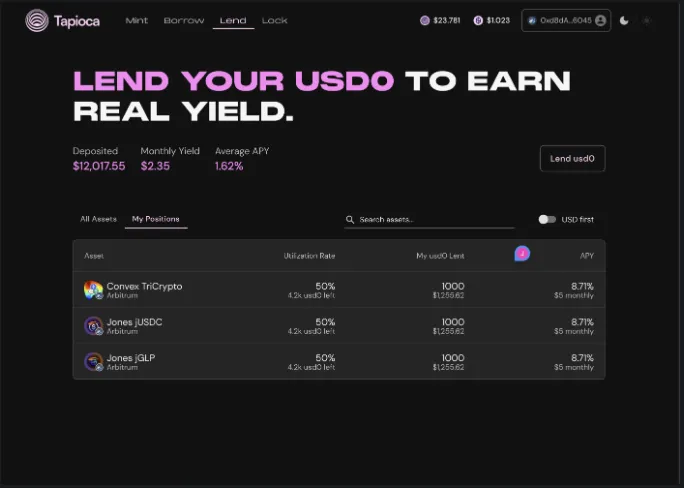

Lending. When choosing a market for lending, pay attention to the utilization rate. The more the market is currently being used by borrowers, the higher your potential return will be. Tapioca will also provide the market with an estimated annual interest rate on loans. Also pay attention to the collateral asset as you are lending to borrowers using this particular asset as collateral. Read more…

Results. What do we have?

- Utilities: omnichain lending, borrowing, minting & teleporting;

- Purpose: to accumulate liquidity belonging to the protocol;

- Benefit: DSO (issuing options instead of tokens) and fees from people using the utility. The mechanics of DSO options (DAO Share Options) results in payment for the protocol, not the market, for $TAP tokens. The protocol will accumulate more liquidity owned by the protocol.

The founder estimates that Proof Of Liquidity (POL) will be around 50 million by the end of the year. This means that the “flywheel” is starting:

✅ More POL > more fees earned;

✅ More POL > less dependence on lockers/lenders;

✅ More POL > deeper USDO liquidity / more USDO usage.

Tapioca DAO is currently building one of the most interesting projects. They create a money omnichain market that allows you to pool assets across multiple blockchains without any problems or risks. The team carefully worked out the tokenomics of the project, providing a stable value for the holders. The size of this project is huge, but the attention to detail that the team is showing makes me believe that they have a good chance of success.