What is RWA?

As the name suggests, RWA - This tangible assets (commodities, real estate, bonds, financial trading, stocks, collectibles)that exist in the physical world.

Previously, Harecrypta wrote an article about RWA - link.

Overview of the state of the RWA sector

The RWA market is located on early stage of developmentbut there are already signs growing adoption And increase in total fixed value ("TVL").

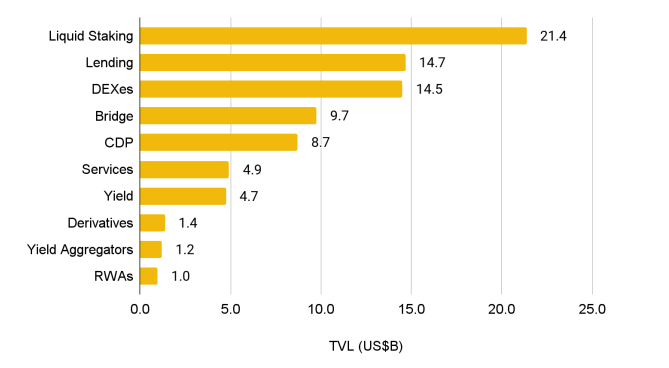

Today RWA is tenth largest sector in DeFi based on the protocols tracked by DeFi Llama, rising from 13th place in just a couple of months. A big contribution was July launch of stUSDT — a protocol that allows USDT holders to earn income based on RWA.

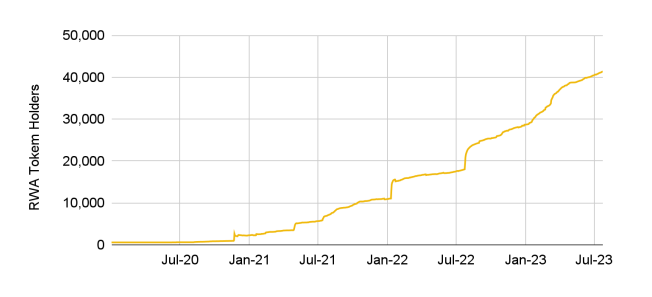

RWA's growth as a sector indicates the increasing adoption of RWA protocols. Currently, there are more than 41.3 thousand holders of RWA tokens in the Ethereum blockchain. While this may not sound like much, the number of token holders has grown significantly compared to last year, more than doubling.

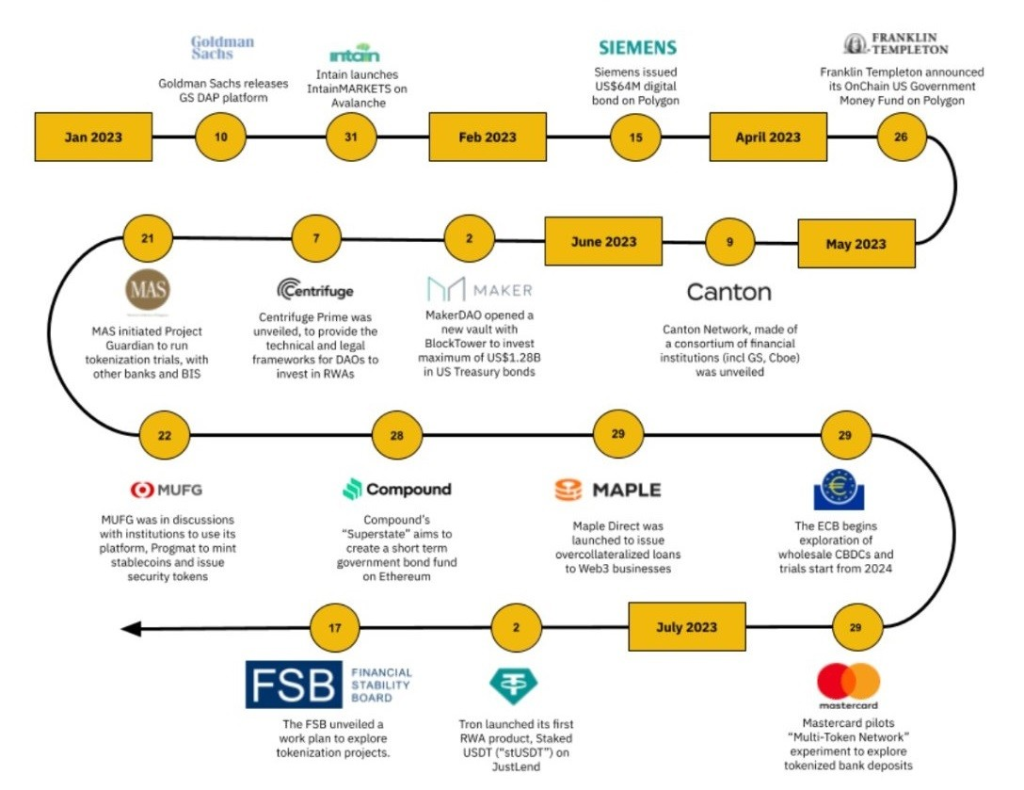

Beyond DeFi protocols, traditional financial institutions have also shown a growing receptivity to RWA tokenization. For example, global asset manager Franklin Templeton launched own fund on a public blockchain. In addition, institutions have also begun to explore the possibility of creating their own private blockchains for asset tokenization.

It is possible that traditional exchanges will facilitate the secondary trading of tokenized RWAs, especially as their adoption grows. In this aspect, the Australian Stock Exchange, as reportedmay consider listing tokenized RWAs in the future.

As the sector continues to evolve, regulatory changes in this area will be the driving force behind mainstream adoption.

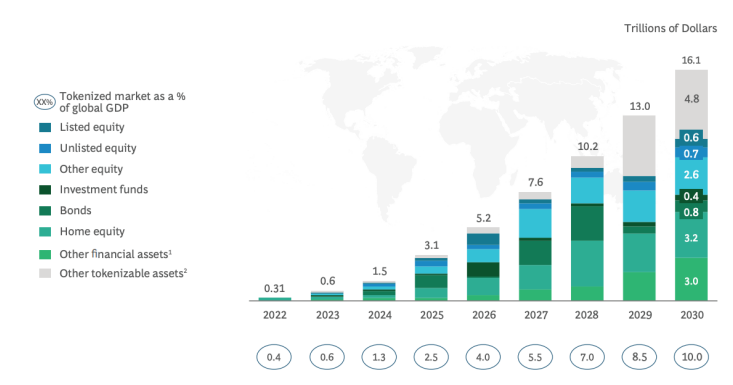

According to report Boston Consulting Group (BCG), by 2030 the market of tokenized assets will be 16 trillion US dollars. By the end of the decade, it will amount to 10% of world GDP. Given the potential market size, capturing even a small percentage of the market would be a boon for the blockchain industry.

Even at a valuation of $16 trillion, tokenized assets will still represent a small fraction of the current total value of global assets, which is estimated at $900 trillion. One could even argue that the true address market is the entire global asset market, given that anything that can be tokenized can be represented as RWA on-chain.

RWA areas to keep an eye on

1) US Treasuries / US Treasury Securities

The tokenization of US Treasury bonds began to gain popularity when everyone saw a clear macroeconomic headwind. For yield hunters, the tokenized US Treasury can provide decent yields to fight inflation.

The US Treasury refers to sovereign debt issued by the US government and is widely considered the benchmark for risk-free assets in traditional financial markets. The risk-free rate of return now exceeds 5%, which is much higher than the average lending rate of top-tier DeFi protocols. This creates a churn from DeFi.

Demonstrating the usefulness of RWA, investors today can take advantage of real returns by investing in tokenized treasuries without leaving the blockchain.

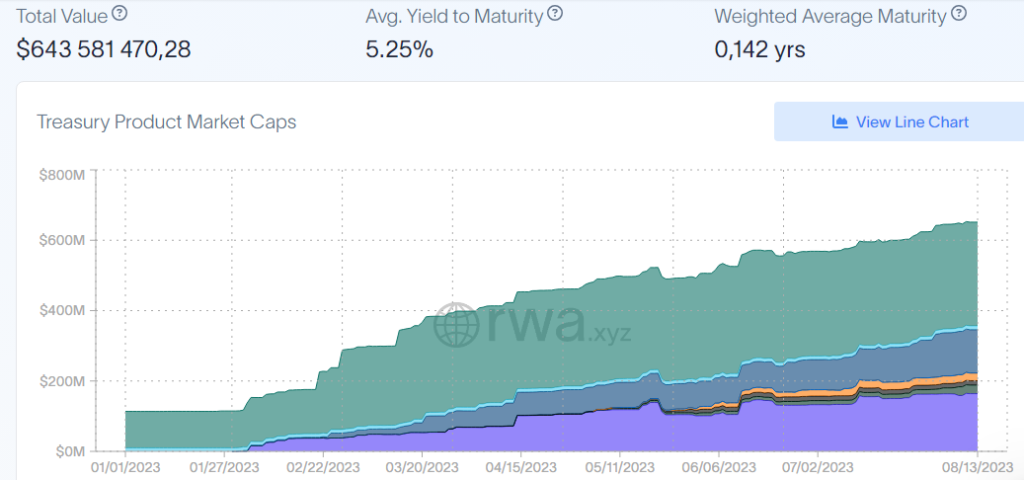

As you can see in the chart below, the TVL of the securities has grown from $100 million at the beginning of 2023 to an impressive $643 million.

Before venturing into this area, conduct your own research - link.

2) Private Credit / Private loan

Users have the opportunity to earn higher returns (although they involve higher risk) by investing in private business loans.

This area is attractive because loans can be directed to real enterprises and make real profits based on business models.

Before venturing into this area, do your own research—for example, link.

Here you need to be extremely careful!

There are many regulatory risks that you cannot anticipate when investing in international real estate.

You need to have certain knowledge in order to be able to justify the risks, returns and entry price for investing in tokenized real estate.

conclusions

RWAs represent a significant opportunity for blockchain-based technologies to open up new use cases and enable more efficient trading and investment.

While there are still some challenges standing in the way of more widespread adoption of RWA in DeFi, it is clear that this is an area of research and development that will continue to play a key role in the future of finance.

Author: @evaneskate