Sequoia Capital holds assets of $ 85 billion.

They have invested in cryptocurrencies > $15B in 8 funds and are by far one of the most famous venture capital funds.

Here is what it is sequoia in 2023.

Sequoia Capital specializes in investing in private companies at the development stage, seed stage, start-up, early stage and growth stage.

Sequoia financed many successful companies, including Apple, Google, Oracle, PayPal, Stripe, YouTube, Instagram and Yahoo.

Sequoia recently announced the separation of its regional divisions (India and China): VC's Indian division was named Peak XV, and the Chinese division of VC - hongshan.

Total assets: $ 85 billion

Crypto funds:

Sequoia Capital Fund

Sequoia Capital Crypto Fund - Liquid Tokens & Digi assets - $500M - $600M

Sequoia Capital India - Venture Capital & Growth Fund ($2B), SEA Web3 Fund ($850M)

Sequoia Capital China - 4 funds focused on cryptocurrencies and fintech - $9B

Investment focus:

- Fast-growing tech startups in various sectors including fintech, medical technology, consumer technology and more.

- Crypto and blockchain technologies

- Investments in companies led by underrepresented groups

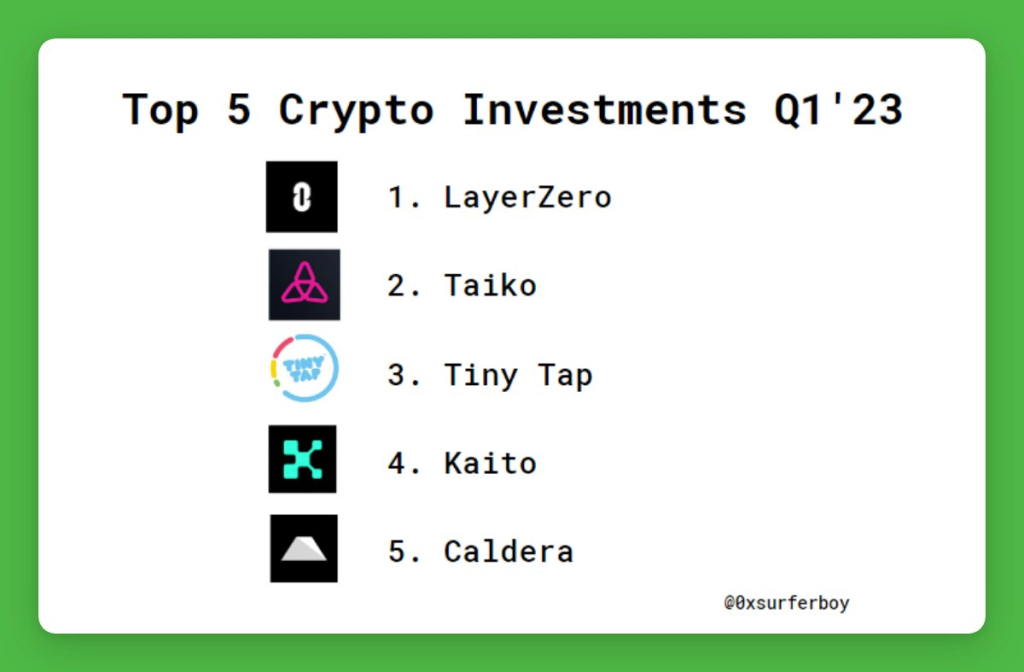

Top 5 Cryptocurrency Investments in Q1 2023

1. layerzero

Attraction: $120M Series B

Lead Investor: a16z

Other investors: Sequoia Capital, Christie's, Samsung's Next, OpenSea, Circle Ventures

TLDR about LayerZero

- LayerZero is a blockchain interoperability protocol that serves as the foundation layer for data transfer and communication between different networks.

- It is used in various dApps like Stargate, Aptos Bridge, L2 like Arbitrum and zkSync.

2. Taiko

attraction: $22M, Seed

Lead Investor: Sequoia Capital China, Generative Ventures

Other investors: IOSG Ventures, GGV Capital, GSR Ventures, Patricio Worthalter, Tim Beiko, Anthony Sassano

TLDR about Taiko:

- ZK rollup of the first type, which strives for EVM equivalence and Ethereum equivalence, which will allow its rollup to support all existing ETH smart contracts, dApps, developer tools and infrastructure.

3. Tiny Tap

attraction: $8.5M, venture round

Other investors: Sequoia China, Polygon, Liberty City Ventures, Kingsway Capital, Shima Capital

TLDR about Tiny Tap

- TinyTap is a platform for creating and selling educational mobile games for kids that helps build a community of creators from around the world.

- Creators can NFT their games, giving them a new way to monetize their creations.

- TinyTap offers a revenue-sharing model where creators can receive a share of the revenue from sales of their creations on the platform.

4. Kaito

attraction: $5.3M, Seed

Lead Investor: Dragonfly Capital

Other investors: Sequoia Capital, Jane Street, Mirana Ventures, Folius Ventures, Alpha Lab

TLDR about Kaito:

- AI-based information databases for cryptocurrency research designed to solve the problem of fragmented information about cryptocurrencies.

- In essence, it is a faster, more accurate and deeper ChatGPT, created specifically for crypto information.

5. Caldera

Attraction: $9M

Lead Investor: Sequoia, Dragonfly Capital

Other investors: NEO Foundation, 1kx, Ethereal Ventures

TLDR about Caldera:

- Caldera specializes in building high-performance, customizable, and application-specific L2 blockchains called Caldera chains.

- These custom optimistic rollups are fast, processing hundreds of TPS with sub-second confirmation times.

- Caldera chains are highly customizable, including address whitelisting or sustainable revenue generation, and are compatible with standard Ethereum smart contract code without modification.

Sequoia Capital continues to actively invest in promising projects and develop the crypto industry. We follow the updates!

Based thread: love mushroom