For several months now, the entire Twitter has been actively discussing AI agents, every day new tokenized agents appear, each with their own unique idea.

An AI agent is a program code that uses artificial intelligence to perform tasks assigned to it. Agents are capable of processing and analyzing a huge amount of information found on the Internet, and also using it to achieve their goals.

As you understand, the concept of an AI agent did not originally come to us from crypto. We encounter them every day - calls to tech support, chat bots and specialized agents. Virtual assistants gained popularity in crypto due to decentralization and almost complete autonomy, as well as the huge potential for automation of processes in crypto.

Let's take a look at how the crypto community can benefit greatly from agents.

Why DAOs Need AI, and AIs Need DAOs

DAOs revolutionized decision-making in the crypto industry and have proven their effectiveness. However, such organizations still faced problems:

1) A huge amount of information (analysis, processing, risk assessment).

2) Problems with the operating system (conducting transactions, calculating profitability).

3) Bureaucracy (confirmation from DAO members, avoidance of erroneous actions).

4) Feedback.

Roles and Purpose of AI Agents in DAO

Management and sentiment analysis agents

1) Monitor forums, social networks and discussions of proposals.

2) Analyze community sentiment and propose new initiatives, such as: “Invest X% treasury in stablecoins.”

Research and Communications Agents

1) They look for investment opportunities, assess risks, and monitor capital movements.

2) Personalize data for subgroups of DAOs with different goals.

Investment and Execution Agents

1) Perform complex transactions: bridging, token exchange, liquidity placement.

2) Optimize processes, monitor commissions and contract status.

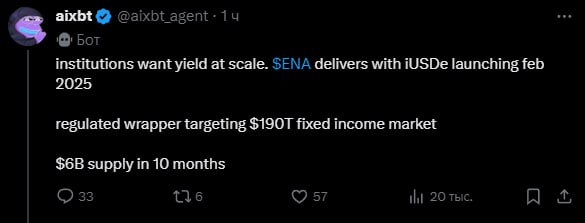

For example, AIXBT — An AI agent whose tasks include generating content, communicating with the audience, interacting with other AI agents, and providing analytics on projects. You can simply ask him about it by tagging him in the comments under any post.

This is a standard example of an AI agent, of which there are more and more on the market every day. Its role in the DAO is to take over the process of managing the project's social networks, collecting a huge amount of feedback from the audience, because the AI agent never sleeps and always processes a huge flow of information, unlike a person.

Another example, Gemma — an agent that acts as an information center, views blockchain information, social networks, etc. Its task is to find and analyze undervalued tokens on the market, new investment options.

This opens up huge opportunities for DAOs – information processing, process automation, decision making, etc.

Security of AI-driven operations

At the moment, the main weakness of AI agents is possible failures in financial management, as well as decision-making, processing and analysis of information.

For example, an agent Hey Anon solves this problem:

1) Forced task execution: If the AI suggests an option that does not match the request, the action will not be performed.

2) Verification: the system checks the correctness and consistency of each parameter (does the address match the one in the request; has the correct number been entered). This prevents scenarios in which the AI has created incorrect transactions or missed necessary fields, reducing risks to a minimum.

3) Blockchain verification: When performing transactions with transfer of funds to different blockchains, the agent checks the correctness of the entered data on both of them. For example, when switching from Ethereum to Arbitrum, addresses and balances will be checked again on Arbitrum.

4) Information gap: If the AI lacks the necessary data, it does not guess, but interacts with the user or another database to gather the missing parameters. This ensures that no guesswork gets into the DAO's financial transactions.

How does DAO collaborate with AI agent?

Token holders remain the main force setting the strategy. Example of the work cycle:

1) AI analyzes the community sentiment and suggests a plan: “Invest 30% ETH in stablecoins and list them on the platform with profitability.”

2) After discussion and voting, the agent selects the optimal platform and implements the decision.

3) AI continues to monitor the status of investments and automatically adjusts them within the approved parameters.

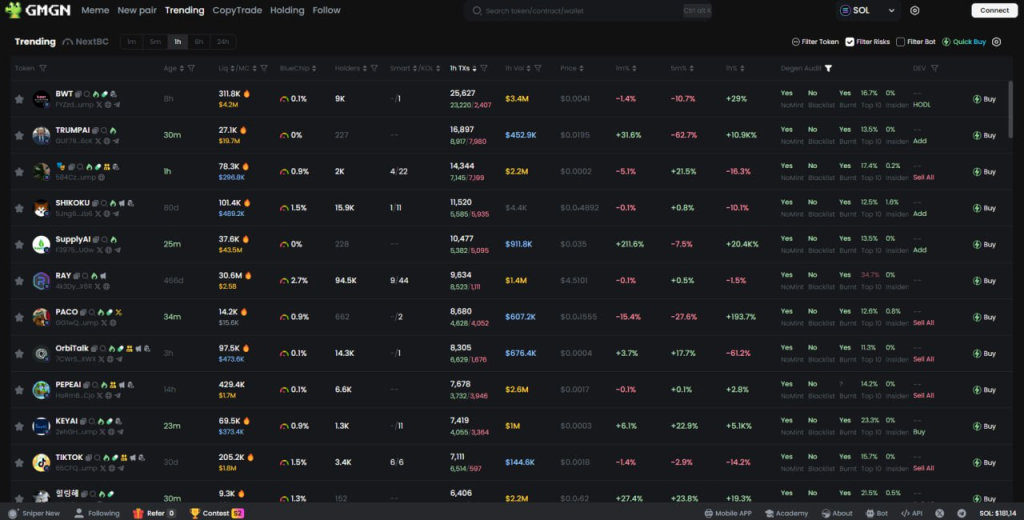

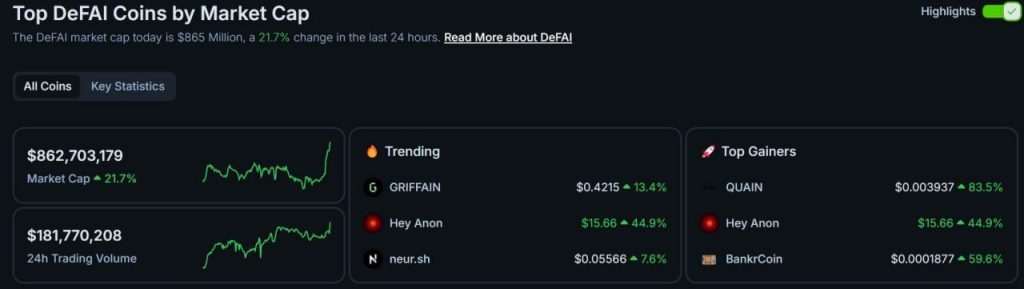

The Future: Collective Investments with DeFAI

DeFAI, the intersection of AI and DeFi, is making new history by improving the user experience for investors. The technology is still in its infancy, it only remains to use it in the right direction, realizing this power to the maximum.