A must read for NFT collectors!

In this topic Kouk.eth makes an overview of the NFT market, tells where the market is moving and what you need to know to navigate it.

Let's dive in! 👇

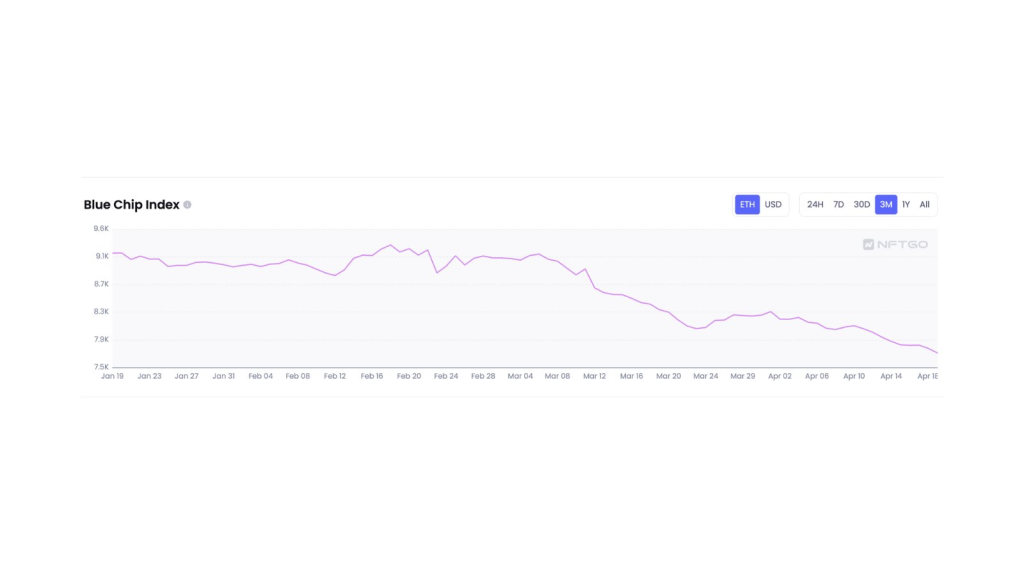

Blue Chip Index

Blue Chip Index has its highs and lows, reaching 9.1 thousand ETH in January and falling to a new low in 7.7 thousand ETH by mid April.

This means that the NFT market is in a bearish trend with reduced liquidity and buying interest.

Volume and traders

In mid-February, NFT trading volume increased by 126.19%, but there were more sellers than buyers, and fewer traders.

This is not very good, as we need to increase the exposure, and for the next ATH we need stable models.

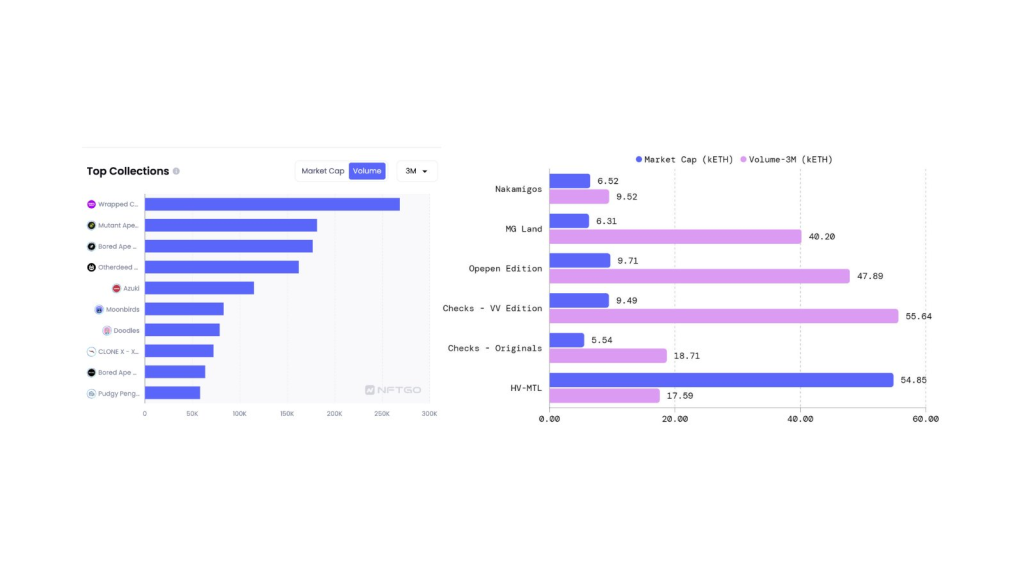

Top collections and trend projects:

CryptoPunks leads in terms of trading volume, followed by MAYC and Bored Ape Yacht Club .

Trending projects in Q1 2023 include:

- Nakamigos

- HV-MTL

- MG Land

- Open Edition

- Checks-VV Edition

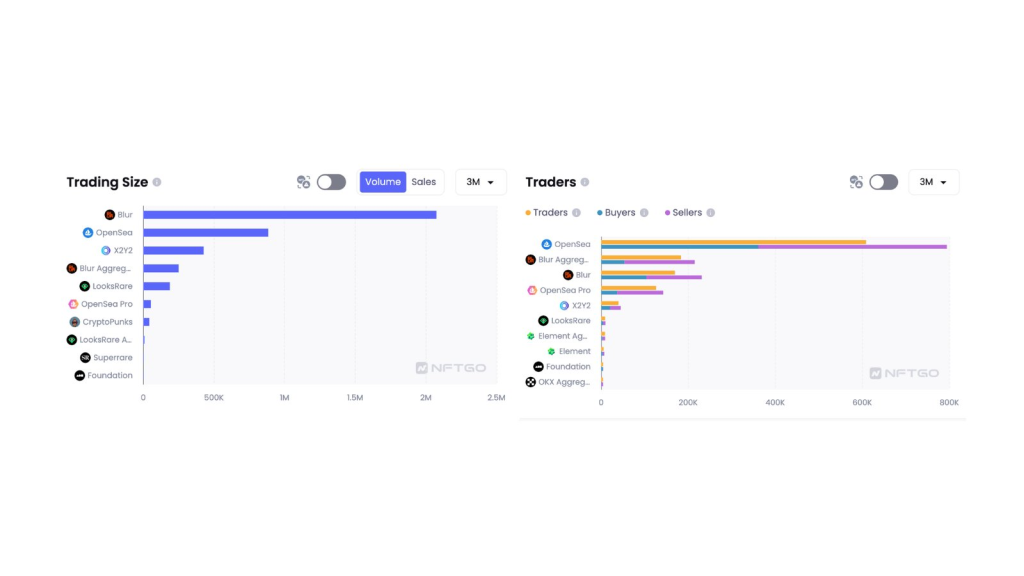

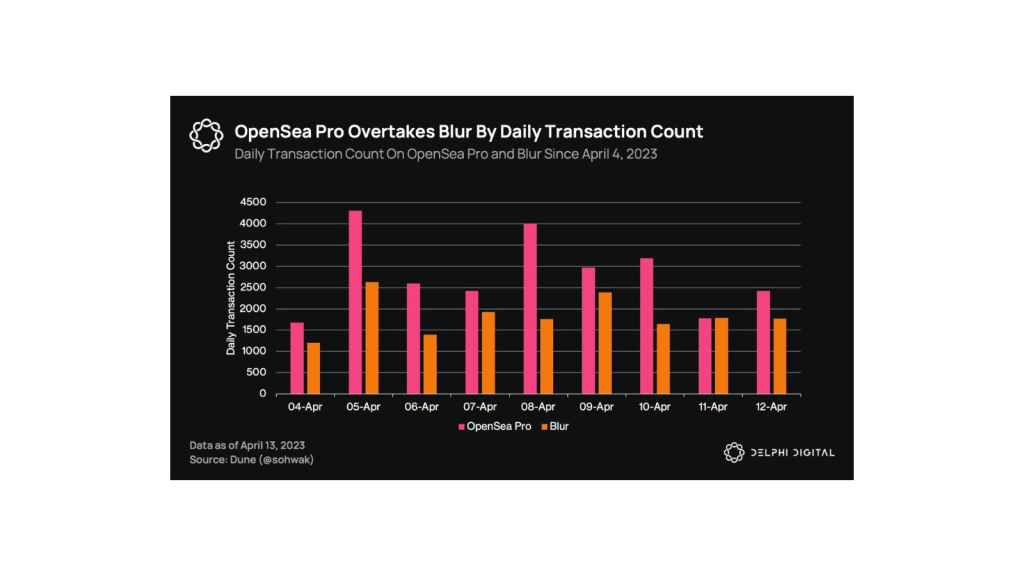

Marketplaces: Blur vs. OpenSea:

Blur doubled trading volume opensea in Q1 2023!

Blur's multi-stage airdrop approach has really boosted engagement and trading volume.

But will it work when the stimulation stops? 🤷♂️

Blur's impact on the NFT market:

upcoming event Blur Halving (Point doubling will stop on May 1st) could have a negative impact on the NFT market, as the number of trading pips will decrease, which may lead to a drop in prices.

Ethereum "Shanghai" update:

The Shanghai update could help the NFT market with 18M ETH, but so far it has a negative effect.

I feel like it could gradually unwind and some liquidity could be injected. Only time will tell.

Opensea Pro & Liquidity:

opensea launched OpenSeaPro is a new MP aggregator, and rewarded previous Gem2 traders with NFTs.

Users received a decent reward, but airdrop Blur was better.

Its daily transactions exceed those of Blur, which arguably boosts liquidity.

DeLabs migration and NFT impact:

Multi-chain interaction was demonstrated by the bridge DeGods III And y00ts from SOL to ETH and MATIC.

I believe this will encourage cross-chain collaboration and give people more opportunities, which will help the market grow.

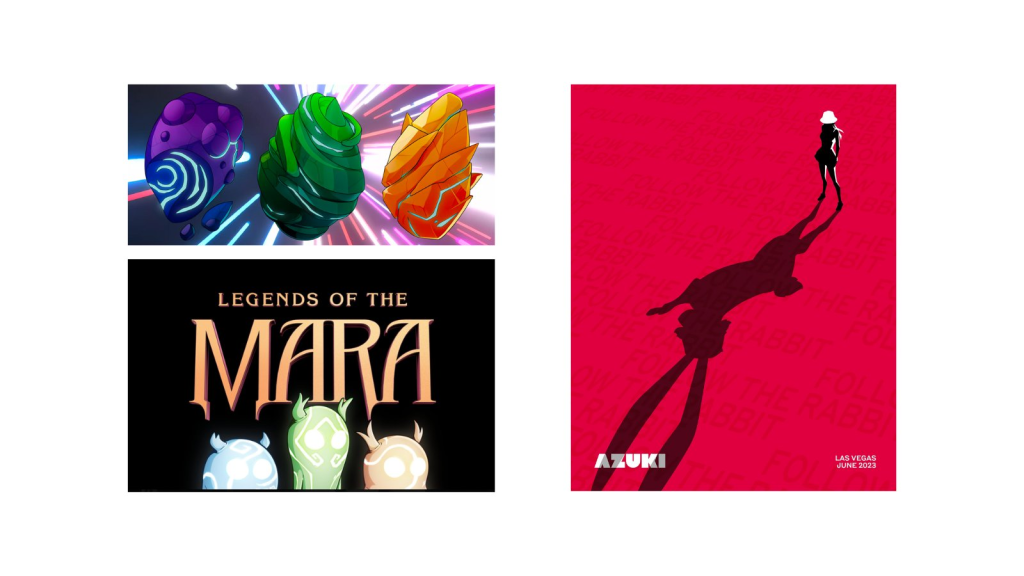

New Bluechips developments:

Yuga Labs stimulates market growth NFTs. YugaLabs attracted more creators and collectors. While at Azuki there were huge sales and a highly anticipated event in Las Vegas.

NFT NYC 2023 Recap:

A week NFT.NYC was full of enthusiasm and optimism, despite the downturn in the market.

Communities NFTs and projects Web3 demonstrated their strength and faith.

#DeFam dominated the headlines on NFT NYC.

ETH rate and market correlation:

The price of Ethereum broke above $2100, signaling a rise in confidence in the cryptocurrency sector.

The price of ETH is closely related to the NFT market.

Cryptocurrencies rise = NFTs fall 🤔. However, this is not always the case.

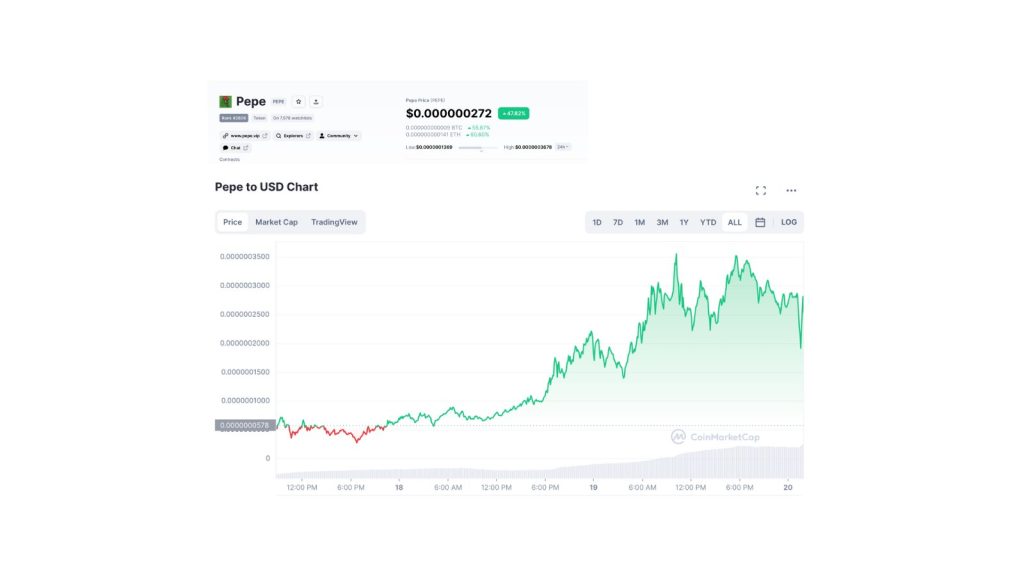

Meme Coin and the NFT Market:

Traders NFTs switch to Meme Coin such as $PEPE, making significant profits.

I think this profit potential can increase the investment and size of the NFT market.

Will people roll their profits into #NFT? 🤷♂️

Bullish NFT Case:

🔸 Multi-chain interaction promotes innovation by stimulating NFT and cross-chain collaboration.

🔸 Large NFT projects increase exposure, spurring growth.

🔸 NFT NYC 2023 demonstrates the resilience of the NFT community.

🔸 $PEPE can stimulate investment in NFTs.

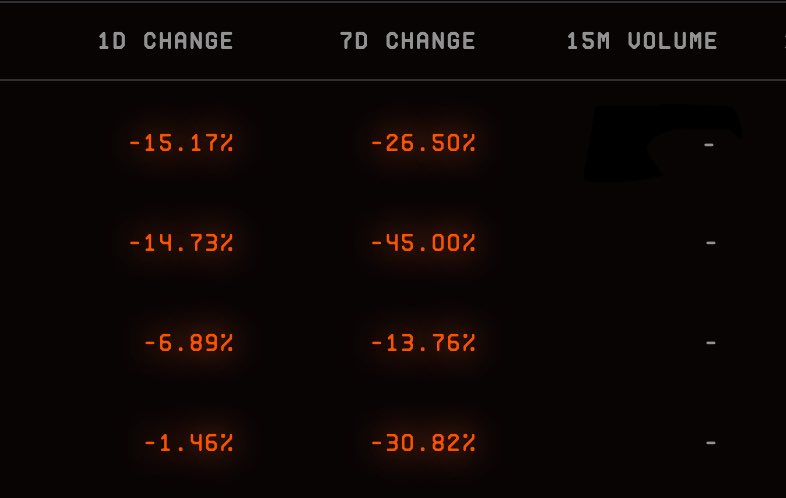

Bearish NFT trend:

🔸 Bearish NFT trend may reduce buying interest and liquidity.

🔸 Blur Halving can lead to fluctuations and lower prices in the market.

🔸 Cryptocurrency corrections affect NFT pricing, although the connection is not always clear.

NFT Market Overview:

Blur Halving, ETH correlation and bearish trends can affect NFT prices.

However, a strong community, new initiatives and adoption are favorable factors.

Cross-chain interaction and participation of Blue Chips can stimulate development.

Personal Thoughts 1 Kouk.eth

I believe that the NFT market has potential, but may face short-term issues with the Blur halving or macro-based correction of cryptocurrencies.

ETH may flow into NFTs after Shanghai update and Meme Coin season.

Personal Thoughts 2 Kouk.eth

Despite all of the above, caution is needed in the market.

I have taken profits on NFT flips but still hold Blue Chips as I look forward to future growth.

65% of my portfolio are stablecoins, which reduces the risk.

This is not financial advice or advice.

TLDR:

The NFT market fluctuates with negative trends.

Blur halving and ETH correlation could affect the market.

A solid community, innovative initiatives and growing adoption are positive signs.

Due to market volatility, caution must be exercised.

Based thread : love mushroom