Ethereum Industrial Internet Revolution!

Based articles Bankless Founder DavidHoffman.bedrock

Cryptoeconomic systems must find a balance

For cryptosystems to stand the test of time, they must be flexible to adapt to changing environments. Rigidity is fragility. Rigid systems will eventually require manual human intervention to keep from breaking. Therefore, cryptoeconomic structures must naturally and automatically come to a state of natural equilibrium, otherwise it will be our inevitable future:

Humans have always used self-balancing mechanisms to manage chaos and complexity.

The development of early steam engines was a series of explosions and uncontrolled chaos. To be useful, steam engines had to produce stable and predictable power, but power level control remained an unresolved issue.

Through the use of a little tricky mechanism called centrifugal regulator, a negative feedback loop was created between the input and output energy. As the output power of the system increased, the regulator began to reduce the amount of input energy.

With a simple application management theory, the unbridled potential of steam was turned into an industrial revolution.

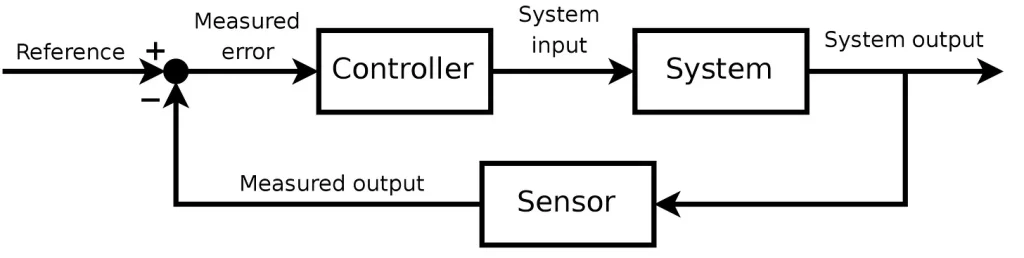

Control theory: The area of mathematics that deals with the control of dynamic systems in engineering processes and mechanisms. The goal is to develop a model or algorithm that governs the application of system inputs to bring the system to the desired state while minimizing any lag, overload or steady state error and providing a level of control stability; often with the aim of achieving a certain degree of optimality.

Alternatively, the airfoil (wing) is at its most efficient when it is at 0° to the ground. As the aircraft rolls, the upward force on the aircraft's wing is reduced as the wing is no longer perfectly "raised".

The dihedral angles of the wings are autodynamically balanced to maintain aircraft roll stability. When the dihedral plane rolls to one side, the upward force on the wings naturally shifts to counteract this. This is a negative feedback loop that helps maintain stability.

Dihedral wings do the opposite! When the plane rolls to one side, the pressure on the wings changes, which contributes to even more roll! It's a positive feedback loop! Why do we design planes with dihedral wings? Because their instability is easily controlled by external influences (namely, steering), allowing pilots to take advantage of other advantages of the folded wing design. But it still works only due to external influence on the system!

Can these same principles of autodynamic balance be applied to cryptoeconomic systems? How can we build the Ethereum economy to balance on its own, even when stupid people do crazy things in it?

Like the centrifugal governor of a steam engine or the self-correcting design of an airplane, cryptography has enabled us to create self-governing economic systems.

The Ethereum project is an attempt to create and optimize the properties of self-government into the engine of its economy. Thanks to key enhancements to the Ethereum crypto-economy, we can now leverage the power of the Ethereum economy and transform it into a productive economic outcome.

Can we create the world's first self-sustaining financial system? Is this what it takes to create a new industrial revolution on the Internet?

I believe that all the signs are on the face. Let's find out!

Ethereum, a self-balancing economic system

In May 2021, the Ethereum engine was the hottest ever.

The gas charge was maintained at 200+ gwei for several months, sometimes 24-hour periods were maintained at 600+ gwei. The Uniswap deal was worth $175. Aave's position was worth $400. The LPing curve cost $1,000.

Token speculation, crop farming, mining, and just general economic activity were so lucrative that the exorbitantly high gas tariffs were something of an afterthought—so much money could be made! Ethereum was red hot.

Ethereum PoW miners have also made insane amounts of money. But due to the PoW economy, miners were forced to sell their ETH to pay for electricity and GPUs - things that are external to Ethereum.

Ethereum was draining its economic energy.

Ethereum's source of income - blockspace gas fees - ended up paying for:

- growth in mining operations

- growth in energy production (and corresponding consumption)

- chip production growth

None of this contributed to the growth of the Ethereum economy. The external PoW industry was absorbing the value of the Ethereum blockspace without recycling any value back into the economy. The economic engine of Ethereum produced huge amounts of output, but this energy could not be used in the real economy of Ethereum. The revenue generated by the Ethereum-focused PoW industry represents the total amount of economic leakage that Ethereum has been unable to contain.

The new circulatory system of Ethereum

The two mechanisms added to Ethereum have greatly increased its power and also translated that power into efficient economic productivity.

EIP1559

EIP1559 translates blockchain demand into the value of ETH, the fuel that powers the engine of Ethereum. With a higher value of ETH, the Ethereum fuel gets more power and the engine runs more efficiently.

EIP1559 is a mechanism that takes heat from the Ethereum economy and uses that energy to refine ETH into a more powerful economic fuel.

proof of stake

Proof of Stake translates blockspace demand into ETH staking yield.

Through PoS, stakers receive tips for transactions (commissions paid in excess of EIP1559 base fee, predominantly by MEV bots), making up ~20% of the total volume of transactions. By injecting transaction tips into the rewards paid to ETH stakers, we are creating a pipe between the heat of the Ethereum economy and staker income.

Through this pipe a negative feedback loop is installed links between the heating of the Ethereum economy and the incentive to invest ETH. An increase in APY staking has damping effect on the economy as higher ETH yields encourage capital outflows from DeFi to staking. Since we've all just completed a 2022 crash course on how interest rate hikes affect the economy, this should be intuitive. The Fed raised interest rates to fight inflation and quell an overheated economy. Ethereum works the same way, raising staking yields when DeFi heats up and lowering them when DeFi cools down. But he does so without the need for a subjective measurement of the economy and without the influence of surrounding political interests.

Returns and regulation

EIP1559 + PoS combo changes the Ethereum economy from unprofitable for regenerative.

The value that was previously unilaterally exported to PoW is instead being redirected to the intrinsic value of the Ethereum economy, and the signal created between transaction volume and ETH yield allows Ethereum to self-adjust between over-speculation and economic depression.

The only input needed is human ingenuity at the application level to generate economic demand for blockspace. Everything else is done by Ethereum.

An economy striving for equilibrium

Two key parameters provide the flexibility needed to create such an environment: emission of ETH and return of ETH.

ETH emission rates regulated by the PoS algorithm, which changes slowly. While PoS needs to be flexible in order to eliminate brittle rigidity, it should only change incrementally as it is the foundation of security for all Ethereum. It should be stable, not changeable.

EIP1559 regulates ETH receipt rate. Unlike the PoS algorithm, the EIP1559 quickly adapts to the changing economic conditions of the application layer. By default, blocks on Ethereum are filled at 50%, and EIP1559 will automatically increase or decrease block sizes and gas fees based on demand.

As the gas fee goes down, the blocks get smaller. As the demand for blockspace increases, the block size also increases, but so does the gas fee! Although target block size always remains constant (15 m of gas), depending on the needs of economic entities, the block size can change up or down.

EIP1559 changes the Ethereum block size to 12.5% depending on the fullness of the previous block. 12.5% in a single block isn't that much, but if blocks spawn every 12 seconds, Ethereum's block size could double within 240 seconds. The block size also has a global maximum size to ensure things don't get out of hand. EIP1559 raises gas prices commensurately until demand subsides and the block size target is restored. This mechanism is like gears in the Ethereum economy. When the Ethereum economy heats up, the engine shifts into higher gear. Block sizes increase to meet demand, fees follow, and ETH is burned. When demand goes out, Ethereum downshifts, reduces blockspace supply, and ETH burn decreases.

Ethernomics

The flexibility of the Ethereum crypto-economy allows it to reach a natural state of equilibrium, even when stupid people play stupid games based on it.

The Ethereum economy is adapting to the environment.

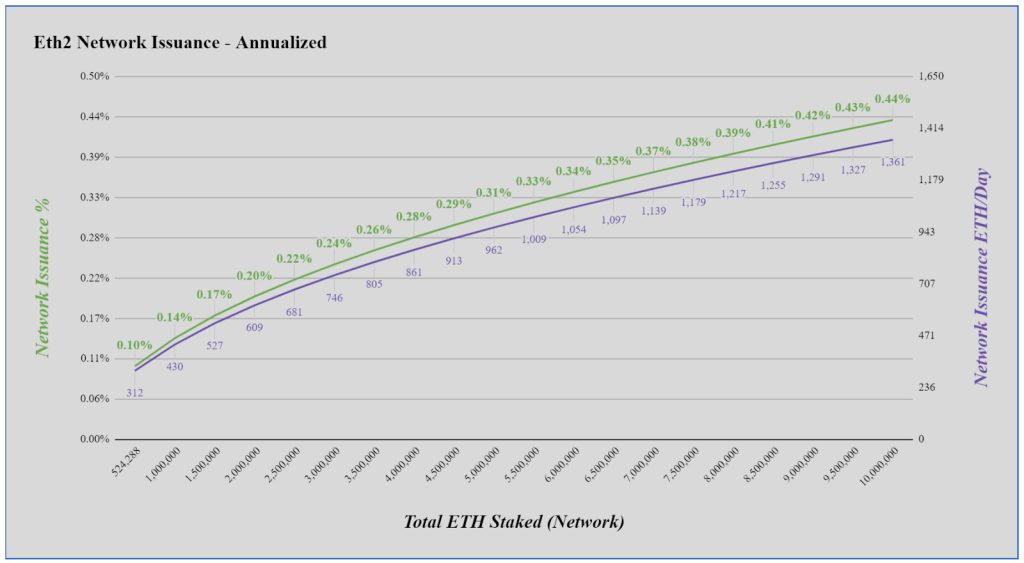

For example, ETH emission rate – as more ETH is deposited on Ethereum, the emission algorithm releases more ETH. However, it gives out proportionately less ETH per validator as the emission is shared among more validators.

When the total amount of ETH deposited in Ethereum low, the returns for individual participants are high, but the total amount of ETH issued low. When the total amount of ETH deposited in Ethereum high, returns for individual stakers are low, but the total amount of ETH issued high.

ETH emission curve:

ETH staking yield curve:

Ethereum certainly pays more for security when less ETH is staked on it

As more ETH is pegged to Ethereum, yields decline and supply rises, mitigating the impact on economic activity by spurring ETH out of staking into the Ethereum economy.

MEV

MEV is an important part of the Ethereum economy. MEV is a pipe connecting DeFi activity to ETH yield. This is the transfer of value from arbitrageurs to stakeholders.

When someone does just about anything on Ethereum, they leave a small arbitrage trail behind. Buying ETH on Uniswap shifts the price and creates a micro-opportunity for arbitrageurs to rebalance the pool.

Economic entities disrupt the market equilibrium, and arbitrageurs automatically restore the system.

As the Ethereum economy grows, arbitrage increases accordingly. General economic activity in Ethereum shows up in gas prices, but MEV activity shows up specifically in gas “tips”; fees that are paid to ETH stakers in excess of the required amount of EIP1559 to allow MEVs to skip the transaction queue and go first.

The net effect is the correlation between staking returns and the economic heat of Ethereum

Search for balance

All of these factors that affect ETH supply and burn rate create an organically balanced system that allows Ethereum to be a zero-intervention crypto-economic system that creates the “fantastic economy” that makes me so excited!

When the Ethereum economy hot, gas prices high, that leads to high burning rate of ETH. Under such conditions MEV high, which increases the profitability of ETH staking. Higher ETH staking returns increase the incentive to stake ETH! This encourages capital outflow from DeFi to the staking protocol, resulting in an increase in the cost of capital within DeFi.

ETH's high yield increases the opportunity cost of capital in DeFi, naturally raising the threshold of what constitutes a viable speculative activity.

Arbitrageurs will always ensure that the cost of borrowing ETH in DeFi is higher than the return on staking. If this is not the case, then there is a free arbitrage opportunity to borrow from DeFi at a lower rate, stake on the protocol, and freely pocket the difference.

By boosting ETH returns at the base level, Ethereum increases the cost of capital in DeFi.

This is a fantastically elegant Ethereum homeostatic mechanism for balancing its own economy, which does not allow a person to interfere in the economy. The only human contribution to the system is the totality of market activity! Everything else is done by Ethereum.

When the Ethereum economy heats up, it naturally increases the pressure on its own breaks! This also happens in the opposite direction: when the economy cools, the pressure eases. The cold economy creates a large ETH supply but low staking yields, making external opportunities look more attractive.

Economy 2.0

At TradFi, there is a tug of war between bond yields and stock valuations.

Low bond yields increase risk appetite, and capital flows from bonds to equities. Asset inflation sets in and credit availability increases. The economy warms up and inflation starts. In response, the Federal Reserve is raising interest rates, and bond yields are following suit. Stocks are selling off as bond yields become attractive again.

The Fed has a hard job. People are stupid and the Fed is not external to the system it runs. The contributions that the Fed uses to make management decisions are responsive to Fed decisions.

Chaotic systems are of two types:

- Systems that do not react to the predictions made about them. The meteorologist's predictions do not change the weather.

- Systems that change as a result of predictions made about them.

Introduction to Game Theory

The Fed operates within a chaotic system that reacts to the Fed's own predictions about it. It is fundamentally limited in its ability to ensure the stability of the economy it manages because the Fed's own contributions are a source of chaos in the system!

Industrial Revolution on the Internet

Ethereum - this is first profitable blockchain in the world.

This is the first cryptosystem that captures its own energy and directs it to a productive result. By redirecting blockspace revenue into the value of ETH, Ethereum naturally increases the total cost of capital in DeFi!

DeFi is on the rise as ETH absorbs flows from the Ethereum economy.

Since ETH is the dominant collateral in the DeFi economy, as the value of collateral rises the availability of loans is expanding!

The Ethereum economy is denominated in ETH, and when ETH rises in value, everything below ETH also rises in value.

Many tokens are traded directly against ETH, via Uniswap or another DEX. Tokens denominated against ETH mean that an increase in the price of ETH is also an increase in the price of tokens. Tokens that are primarily traded with stablecoins are still affected by the price of ETH as the appetite for stablecoins rises when ETH can be used to borrow or mine it, and borrow more of it as ETH becomes more valuable.

EIP1559 gives the entire Ethereum economy a tailwind of economic growth. As the value of ETH rises increasing the availability of capital.

Growing wealth is getting easier. Investment in Ethereum is on the rise.

The positive effect of EIP1559 is not limited to a simple increase in the value of ETH. ETH is closely intertwined with DeFi and the rise in the value of ETH is having a significant positive impact on the entire Ethereum economy!

Let's call it "ETH wealth effect.”

Some people mistakenly believe that the deflation of ETH will lead to a decrease in economic activity in Ethereum. Everything is just the opposite. The deflation of ETH increases the availability of all other forms of capital and stimulates the investment and activity of this capital.

Ethereum will be able to finance its own future.

Unlocking the Industrial Revolution Online

We are watching the world of cryptoeconomics unlock a new performance engine for the internet age.

The Internet revolution will not be complete without cryptoeconomics. Before digital money and finance, we were stuck in a pre-internet stage; it was a data-only version of the internet.

Cryptoeconomics is the study of creating economic engines for the Internet. With the invention of bitcoin in 2009, a new class of engines was opened up and an entirely new industry arose around it.

Since then, Ethereum has been streamlining the science of cryptoeconomics. What used to be an inefficient lossy performance engine has now become a super engine for the digital age.

Ethereum heralds an industrial revolution for the internet. Just as the steam engine became the raw material needed to start the industrial revolution, Ethereum's stunning new crypto-economic engine is ushering in a new era of economic productivity and online prosperity.

We have already seen this story. We know what happens next.

The dots that connect here are not that far apart.

Height. Entrepreneurship. Inventions. Connections. Wealth. Prosperity. Improving the level and quality of life.

That's what's ahead of us once we figure out how to operate this damn thing. 😅

It does not constitute financial or tax advice. This information is for educational purposes only and does not constitute investment advice or a call to buy or sell any assets or make any financial decisions. This article is not tax advice. Talk to your accountant. Do your own research

Translation author: Inna